Cebu City Mayor Michael Rama wants the fair market value in the revised real property tax (RPT) ordinance to reflect the current rate, despite calls from businessmen to stagger its implementation.

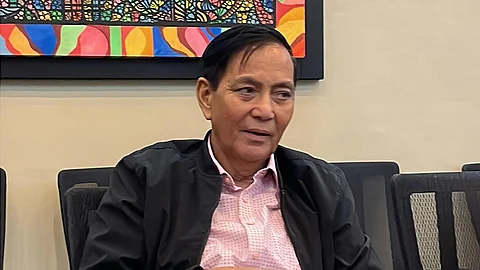

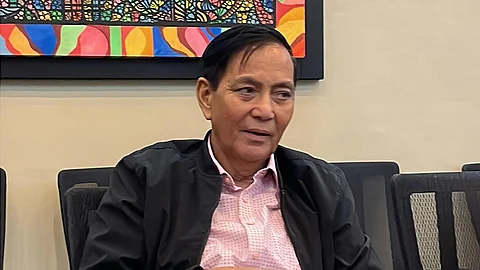

“Pass the law, and we can discuss the implementing rules after,” Rama said over Cebu City Hall’s online program “Ingna’ng Mayor” on Thursday, Feb. 29, 2024.

As the mayor of the City of Cebu, Rama said he wants it approved.

On Tuesday, Feb. 27, Rama urged the City Council to pass the ordinance pertaining to the revised RPT before the end of this month.

However, City Councilor Noel Eleuterio Wenceslao, chairman of the committee on budget and finance, said he still needs to meet the other councilors to discuss the matter and reach a consensus.

Wenceslao said jumping to final deliberations without having the stance of the majority might simply defer the ordinance.

In his point of view as a lawyer, Rama argued that implementing rules may be deferred within reasonable time to allow those affected to adjust their operational and financial management.

“But let the fair market value already be back to what it is at the current time,” Rama said.

Rama found it unfair that property owners have enjoyed paying taxes based on the value 20 years ago.

The RPT Code of Cebu City was last revised in 2002.

“Ang yuta bayran na unta (The tax paid on real estate should be) on the present value,” Rama said.

He said it is the rich’s corporate social responsibility to share by paying the right amount of taxes.

Reaction

On Saturday, Cebu Chamber of Commerce and Industry (CCCI) president Jay Yuvallos said they are proactively working with the mayor, his team and the City Council on this.

On the matter of the fair market valuation, he said they hope that it will reflect a truthful and realistic value.

“Certainly not based on speculation (bloated), a reflection of a fair value will also protect the land owner,” he said.

He said the mayor has also intimated that the implementation will be on a staggered basis.

“What is important and the clamor of everyone is that the increase will be gradual so that it becomes affordable. This is subject to a more thorough discussion when we get there,” he said, adding: “We also take cognizance of the fact that they need revenues to finance projects which we also want to see very soon, especially infrastructure projects that can significantly impact the lives of every Cebuano.”

Yuvallos said the goal of the chamber is to help its members and the business community in general to expand and grow business.

“This will in effect widen the tax base (not only RPT) as a source of revenue for the City. We will work with the City on the ‘Ease of Doing Business’ and helping promote a Business-Friendly Cebu City as what the mayor wanted to espouse,” he said.

He said the CCCI will introduce programs that will encourage expansion and investments into the city and promote global competitiveness of the enterprises in Cebu.

Proposed ordinance

Under the proposed ordinance, the formula for deriving the total tax due as explained during the public hearing Friday is getting first the market value of the property. This can be determined by multiplying the land area by the fair market value (FMV).

Skyrocketing taxes

Afterwards, the market value will be multiplied by the assessment level, which will generate the assessed value. Then, the assessed value will be multiplied by the three percent tax rate. The result is the total tax due.

For instance, a 1,493-square-meter commercial property in the Cebu IT Park with a current tax due of P26,874 will have a tax due of P895,800 once the updated tax ordinance gets implemented.

Similarly, a portion of Cebu Business Park under the jurisdiction of Barangay Hipodromo will see its FMV shoot up to P245,000 from P16,300 per square meter, significantly affecting the RPT that Ayala Land will have to cough up if the measure is approved.

In the proposed RPT ordinance, the market value of properties in some prime locations in Cebu City is expected to increase from 200 to 3,200 percent.

Mayor Rama urged the passage of the RPT Code in order to raise funds to realize the objectives of his administration like the Gubat sa Baha (War against Flooding) and other projects like the transitional housing that will house the families affected by the clearing of three-meter easement zones.

On Cebu City Hall’s online program “Pagtuki, Pagsusi, Pagsuta” on Wednesday, Feb. 28, City Budget Officer Jerone Castillo said P600 million is intended for the design and construction of 600 transitional housing units for the first phase of the project.

The P600 million is one of the items in the first supplemental budget that the executive department has requested the council to approve this year.

Other items include budget allocations for the Palarong Pambansa, Charter day bonus, and adjustments for the City Council.